How Do I Explain Sequence of Returns Risk to Clients — and Mitigate the Risk?

One of the most common frustrations insurance agents and financial advisors face when discussing annuities isn’t performance, fees, or even liquidity — it’s client understanding.

Clients hear phrases like “long-term average returns” and may feel reassured. What they don’t realize is that the order of those returns can matter just as much — especially once they retire and begin taking income. This disconnect often makes it difficult to clearly explain why guaranteed retirement income solutions, like annuities, deserve a place in the conversation.

That’s where sequence of returns risk becomes one of the most important — and least understood — concepts in retirement planning.

What Is Sequence of Returns?

Sequence of returns refers to the order in which positive and negative market returns occur over time. During the accumulation years, this risk is largely invisible. When clients are still working and contributing, market ups and downs tend to average out.

But retirement changes everything.

Once clients begin withdrawing income, early market losses can permanently damage a portfolio, even if long-term average returns remain strong. Withdrawals taken during down markets mean fewer assets remain to recover when the market rebounds.

What Is Sequence of Returns Risk?

The term “sequence of returns risk” is the risk of negative market returns that happen late in a client’s working years or early in retirement.

While some people may say “sequence of return” — singular — it’s important to distinguish that the risk isn’t about a single return; it’s about a sequence of several returns. And while it’s possible that sequence of returns risk can happen late in retirement, it’s generally most severe in the early years of retirement due to the double whammy of withdrawals and poor returns occurring at the same time — a combination that can compound the depletion of funds, making it difficult or impossible for a portfolio to recover.

In other words, two retirees can experience the same average return, yet have very different outcomes, including the possibility of running out of money altogether.

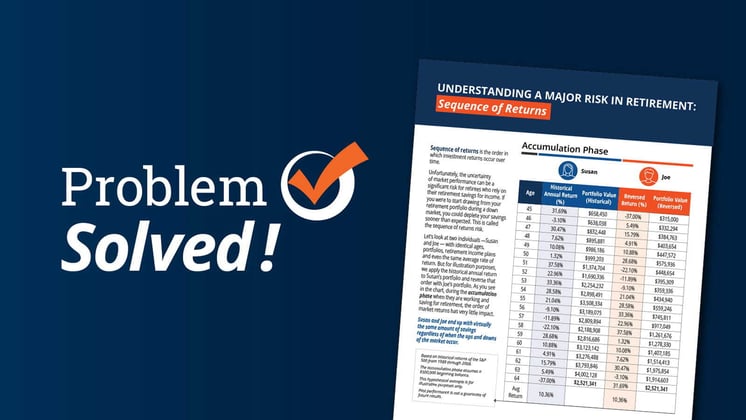

Sequence of Returns Risk Chart: A Simple Illustration Clients Understand

So how do you explain sequence of returns risk in an easy-to-understand way to clients?

One of the most effective ways is through a side-by-side comparison.

Consider two hypothetical retirees — same age, same portfolio value, same withdrawal strategy, and the same average rate of return. The only difference?

The order of market returns:

-

One retiree experiences positive returns early in retirement and market declines later.

-

The other retires into a down market and sees losses early while taking income.

The result is dramatic. The retiree with early positive returns maintains portfolio longevity and flexibility. The retiree who encounters early losses may deplete their assets years sooner — even though the average return is identical.

This visual, story-based explanation helps clients grasp a difficult concept quickly — without technical jargon or fear-based messaging.

Sequence of Returns Risk Explained for Clients

Get this FREE PDF/flyer that illustrates the danger of poor early returns on a client’s portfolio compared to good early returns.

Where Guaranteed Retirement Income Fits In — Naturally

Once clients understand sequence of returns risk, the conversation shifts organically.

The question becomes:

“How do I protect my income if the market declines early in retirement?”

You can then explain solutions that can help mitigate the risk of early market downturns.

Repositioning a portion of retirement assets into guaranteed income solutions, such as fixed or fixed indexed annuities, can help:

- Provide predictable income regardless of market conditions

- Reduce dependence on portfolio withdrawals during down markets

- Create confidence that essential expenses are covered for life

This isn’t about replacing growth — it’s about protecting income timing which is exactly where sequence of returns risk does the most damage.

When speaking to annuities and income, you may want to emphasize that annuities are “contractually guaranteed retirement income that you can never, ever outlive, no matter what is happening in the broad markets.” If there’s a market correction like in 2008, the income your client has contractually locked in will come in like clockwork.

More Methods to Illustrate and Mitigate SORR

Agents and advisors can discuss and illustrate other strategies to mitigate sequence of returns risk, including:

- Building diversified portfolios or “buckets” that shield near-term needs from market volatility

- Developing a retirement income plan with multiple strategies such as conservative spending during the “go-go years,” ample cash reserves, and dynamic withdrawals instead of a fixed withdrawal rate

- Tapping the cash value in whole life, universal life or other insurance policies

Which Professionals Can Discuss Sequence of Returns Risk With Clients

Whether you’re an experienced wealth planner or a new health insurance agent, helping your client understand sequence of returns risk shows them that you care. Connecting them with solutions to mitigate the risk can strengthen your relationship even further. There are ways for you to help them, even if you’re not an expert in retirement planning.

For example, are you a Medicare agent looking to expand into retirement income planning but unsure how to explain annuities with confidence? Or maybe you fully understand SORR but need marketing materials to explain it to clients easily or tools to illustrate portfolio longevity, bucket strategies or other retirement income planning concepts.

At Senior Market Sales® (SMS), expert marketing consultants can share effective sales concepts, identify cross-selling opportunities and connect you with what you need to help clients, including:

- Annuities for sequence of returns protection

- Software tools and platforms for retirement income planning

- Annuity training

- Referring clients to other trusted retirement planning professionals so you can address sequence of returns risk while keeping their business

Lead with Education, Not Sales

Keeping your clients’ needs as the focus — not sales — is the key to effectively communicating about sequence of returns risk and the need to mitigate it. At SMS, we know agents and advisors are most successful when conversations are educational, visual, and client-focused.

That’s why we provide easy-to-customize marketing tools — like our sequence of returns client piece — that:

- Clearly illustrate a complex retirement risk using real market returns

- Position contractually guaranteed retirement income as a logical solution

- Support compliant, professional conversations

- Save you time while elevating your message

These materials are designed to help clients see the problem before you ever discuss a product.

A Free, Easy Way to Illustrate Sequence of Returns Risk … And More

If you would like to hear how top advisors use the customizable SORR piece to educate their clients and how you can use it to generate annuity conversations, simply fill out the form below.

This piece and others in SMS’ Client Stream® marketing library are free, exclusively available through SMS, and built to help you have better conversations, not just more conversations.

SMS also offers annuity training in its SMS Learning Academy. Whether you’re a health agent looking to expand into annuities or a seasoned annuity producer, you’ll find valuable tips, sales concepts and product insights that can fuel your business’ growth.

The annuity training is free — just register for a MySMS account if you don’t already have one.

I’m interested in learning more about SORR!

FOR AGENT USE ONLY. NOT TO BE USED FOR CONSUMER SOLICITATION PURPOSES. This material is not a recommendation to buy, sell or roll over any asset, adopt a financial strategy or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition or particular needs of any specific person. Clients should work with their tax professionals to discuss their specific situation.

Why Should You Talk to Your Clients About...

Roth conversions represent one of the most beneficial tax techniques that an advisor has in their toolbox. Transitioning money from a traditional...

Tax Burden to Tax-Free: Roth Conversions in...

The One Big Beautiful Bill Act (OBBBA) has passed. What does that mean for you as an insurance agent or financial professional? Also, what does it...