Marketing That Drives Your Growth

Gain access to exclusive markets and reach prospects with easy-to-implement marketing programs proven to build your business.

The Value of SMS Financial Solutions Marketing

Save time and get results faster when you don’t have to build your own program — or abandon ones that failed and start over.

Reach prospects in difficult-to-access markets using programs only available through Senior Market Sales® (SMS).

With so many programs, you can choose those that work for you and never worry about where the next client will come from.

Choose Your Leads

The first-of-its kind Client Stream® Lead Exchange platform matches prescreened vendors with agents who want them. You choose your price point, which leads you want and when you want them. Get exclusive access to leads, inbound calls and warm transfers from the top companies in the marketplace.

Gain Access to 403(b) Savers

SMS’ exclusive Monument Benefits® program removes longstanding barriers to public employees in the trillion-dollar 403(b) space. Use a revolutionary technology platform that streamlines the enrollment and rollover process, speeds communication and more. Get listed as a preferred provider in your area.

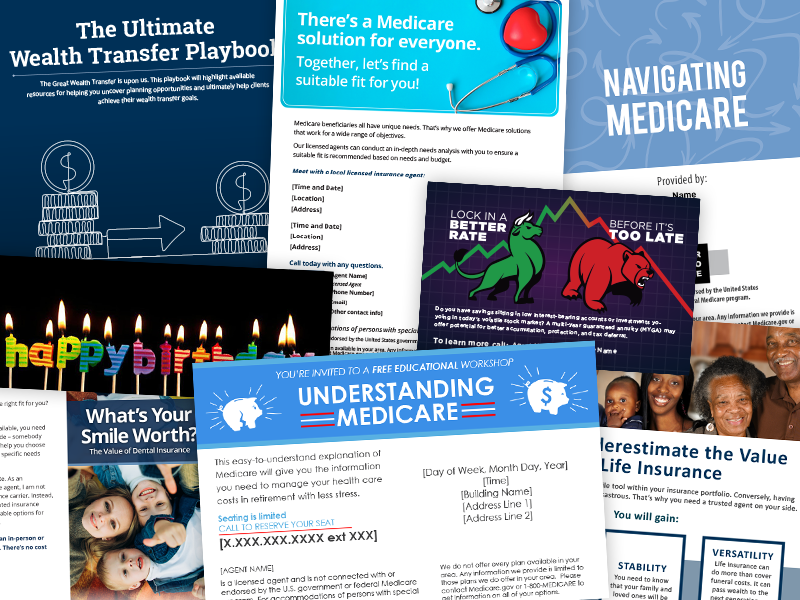

Reach Retirees at Key Decision Points With SMS Workshops

Attract pre-retirees and retirees with educational workshops that answer their key retirement decisions, such as when to claim Social Security and how to enroll in Medicare plans. Get everything you need — from compliant marketing materials to the presentation script — to conduct workshops and the follow-up appointments that convert to sales.

Earn Marketing Dollars With Your Annuity Production

SMS’ OvationTM program goes beyond the usual cash-back rewards to truly honor and elevate premier producers in tangible ways. By investing in your business with marketing assistance designed to continuously take your production higher, Ovation does more than keep you going — it keeps you growing.

Get Marketing That Delivers Results

Tell us which marketing programs you want, so we can get you started.