How Insurance and Financial Planning Professionals Survived the COVID-19 Pandemic

The COVID-19 pandemic forced many insurance and financial planning professionals to reconsider how to do business, as in-person workshops and face-to-face appointments with clients came to a screeching halt. Many, however, discovered that the shut-down didn’t have to mean a decline in business. For many, they came out even stronger and better positioned to thrive moving forward. How’d they do it?

Senior Market Sales® (SMS) helped advisors quickly pivot to take all aspects of their practices online, so they could service clients and even reach new prospects. Just as their clients relied on them for support during the crisis, these advisors leaned on SMS to carry them through. SMS encouraged advisors by saying the pandemic was not the time to capitalize on client fears; rather it was a time to be there for clients – despite the physical barriers and bans on interaction. And most importantly, SMS had solutions that kept advisors’ businesses running. For many, the solutions were so efficient and useful that they continue to use them to save time, work faster and meet customers in a post-pandemic world that’s dramatically different than before. You may, too.

How to Meet With Clients Online or By Phone

While you may prefer in-person meetings, there are many options today to help you connect with clients so you can maintain your relationship and serve them. You can call them and use some of the carrier or SMS enrollment tools, and you also can use video conferencing technology with only your smartphone, laptop, tablet or desktop computer.

If both you and your client have iPhones, for example, video conferencing can be as easy as a tap – just use FaceTime to see each other.

Most video conference vendors offer the service for free, but some offer paid plans. And features generally include audio-only or full-video chat, screen sharing and mobile apps.

Vendors include:

- GoToMeeting

- Zoom

- Skype

- Join.Me

- Google Hangouts

- FreeConference

- Facebook Live

- TrueConf Online

- YouTube Live

- Slack Video Calls

You don’t have to be a videographer to do video conferencing, but it is smart to be aware of such things as proper framing, lighting and etiquette, such as wearing appropriate business attire, being on time and looking into the camera without distractions. It’s also smart to test your technology well before you start. And also before you start, turn off your notifications, so you are not distracted but also so if you’re screen sharing your clients don’t see them.

Virtual meetings are so effective that you may find that you save time and money, such as travel costs.

Schedule Educational Workshops Online

Video conferencing was a quick and easy solution for already-scheduled educational workshops that could no longer happen in-person because of COVID-19 restrictions. SMS understood that for some advisors, workshops often drive the majority of new client acquisitions and revenue, so we worked quickly to develop options to keep those workshops going.

Those same solutions can work today, should an emergency or other unexpected event impact an already scheduled workshop. Simply communicate to registrants that the in-person event is canceled and that you’ll either reschedule or send a recording. To do that, choose the online video conferencing platform service you feel most comfortable using, record your presentation and then email registrants a link so they can watch the webinar on demand, when it’s convenient for them.

You also can offer to do the educational workshop in a one-on-one appointment for a video meeting in which you walk through your presentation.

Whether you’re doing educational workshops all on your own or utilizing different levels of support available from SMS, a marketing consultant can help you transition your workshop online.

Even if you’ve never done educational workshops before, now is a great time to consider adding virtual workshops to your marketing plan.

Reaching Out to Clients

While the pandemic may be a once-in-a-lifetime occurrence, SMS recommends that same approach for other local or world events that impact clients. In a relationship business in which clients turn to you for advice, remaining silent can send the wrong message. Reaching out shows that you understand the gravity of the situation and that you care. But what will your message be?

The answer depends, of course, on how you can help. Make sure your message is essential and useful. Also, due to the nature of insurance and financial planning advice, it’s important that whatever you say over the phone or in an email is free of scare tactics.

Your clients may need to talk through their concerns, whether that’s health-related or market-related. If you haven’t already reached out to clients, do so, whether by phone, video chat or email. It may be as simple as asking how they are doing and what they’re concerned about. Then offer your services to help.

Immediate Ways You Can Help Clients in a Crisis

The pandemic highlighted the importance of understanding clients' health risks so that you can acknowledge and respect them and provide valuable information. Because people age 65 and older are at a greater risk of becoming seriously ill with COVID-19, your older clients’ health is likely at the forefront of their concerns. Understand what Medicare covers and costs related to COVID-19 testing and treatment, and make sure they know about telemedicine options that allow them to see doctors without having to leave their homes. If you’re a licensed agent specializing in Medicare, keep your eyes open for bulletins issued by carriers on relevant public health events and stay current on health issues in the news. For state data, including current cases, deaths, health coverage and provider capacity, visit the Kaiser Family Foundation state data coronavirus page.

For many clients, the fear of losing their retirement investments was a top and immediate concern, as markets reacted to the global pandemic. Touching base with those clients is critical. While a diversified portfolio before a market downturn is more important than any one-product solution, reviewing a plan and talking through client fears now can help them address those feelings and perhaps prevent irrational, damaging decisions. Depending on your client’s time horizon and objections, the volatility may present a buying opportunity. For some clients who may be seeking safety, the opportunity may include fixed-indexed annuities or multi-year guaranteed annuities. Again, an SMS marketing consultant can help you find that right solution, whatever your clients’ needs.

Another way you can show your value to clients is to remind them that scammers take advantage of situations like the pandemic to target them. As government officials ironed out the details of how stimulus checks would be distributed to Americans, the Federal Trade Commission (FTC) reminded the public that only scammers will ask you to pay anything up front or to provide your Social Security number to get the money. Tell your clients that they can stay up to date with the latest coronavirus-related scams at www.ftc.gov/coronavirus or by signing up to get these consumer alerts.

How to Conduct Routine Business Virtually

Agents and advisors during the shutdown were able to conduct routine business as usual, because SMS has tools that assist your virtual work.

Insurance carriers offer a variety of enrollment methods, and SMS has its own propriety enrollment methods that are approved by carriers and allow the agent to sell to the consumer in the way that the consumer wants.

SMS’ proprietary Lead Advantage Pro® all-in-one sales management tool can help you with everything from obtaining the required Medicare Advantage and Part D Scope of Appointment (SOA) permission online or over the phone to submitting and completing applications online, which is faster, more accurate and easy to use. You can manage leads, retrieve online forms, generate online quotes and more using Lead Advantage Pro. (If you have clients who never or rarely use the internet or computers, you can help them by setting up a no-cost email account such as Gmail.)

Lead Advantage Pro is not just for Medicare sales. You can use the platform for life insurance sales, specifically final expense – to run quotes, assist in your clients’ health class assessment and access applications and marketing materials. SMS has an entire library of video tutorials that demonstrate how to use Lead Advantage Pro, so you can get up and running quickly.

For virtual annuity sales, SMS offers an e-App platform powered by FireLight’s e-App process. With it, you can avoid the hassles and cost of doing business with paper applications. It’s easy to use and gives you one place to submit all your annuity business, eliminating the need to navigate different carrier websites. You also can get up-to-speed quickly with FireLight video tutorials.

Taking your long-term care (LTC) insurance sales virtual is easy – simply contact an SMS marketing consultant. With so many different types of LTC insurance and so many factors that go into finding the right solution for a particular client’s needs, starting with a call to an SMS marketing consultant who specializes in LTC insurance will save you time and ensure that you find a customized solution for your client. The combined expertise of the SMS LTC team will help identify the right LTC insurance solution, so you don’t have to spend the time researching products and finding the online marketing materials and applications. You can use Lead Advantage Pro to access electronic forms and for submitting e-Apps, but start by calling an LTC marketing consultant for the best experience for both you and your client.

Self-Enrollment Options Can Fuel Online Sales

SMS also offers self-enrollment options such as the agent initiated consumer online enrollment (AICOE®) platform and Medicare Insurance Direct (MID).

AICOE is an easy and compliant way to help your Medicare Advantage with Part D (MA-PD) clients enroll online. It integrates with the carriers so your clients' information carries over with no hassles – and you avoid repetitive input of client info on multiple carrier sites.

MID is a sales solution that allows MA-PD clients the ability to quote and enroll themselves in a plan online, while at the same time, ensuring that you still receive credit for the sale.

With MID, agents still show their value by using their knowledge to match beneficiaries with available plans based on individual healthcare, prescription drug needs and estimated out-of-pocket expenses, while making it convenient for the client to enroll online, at their convenience. You send your client a Personalized Universal Resource Locator (PURL) – a unique web address – that takes them to a micro-site displaying the states and carriers that the agent is properly credentialed to sell, including MA-PD, PDP and Medicare Supplement. The PURL links the sale to your agent writing number so you get the credit. The site sells for you 24 hours a day, seven days a week.

Some dental carriers also offer PURLs through SMS. Contact a marketing consultant to get started.

How Workshops With Technology Work Together

Did you know that you can use SMS’ Client Stream® educational workshops to attract prospects. SMS offers solutions to help you pivot from in-person meetings and workshops to virtual ones if the climate calls for it. And because SMS’ Client Stream program offers everything – the script, presentation, marketing materials and an extensive guide – starting workshops is easier than you imagine.

The powerful combination of educational workshops and technology is unique to SMS, and with nearly four decades in the industry, SMS has the expert knowledge on the workshop topics known to resonate with pre-retirees and retirees:

- Social Security planning

- Long-term care planning

- Understanding Medicare

- Taxes in retirement

- Understanding annuities

- Core retirement decisions

Call an SMS marketing consultant to discuss how you can start using virtual educational workshops for a steady stream of clients and how to pair them with the respective technology.

Email, Direct Mail and Social Media Campaigns

In high-profile news events like the pandemic, consider increasing or starting email, direct mail or social media campaigns. SMS partners with vendors who specialize in these areas and can help you.

They can do everything from providing the content to emailing it to your client and prospect lists. If you’d like to reach prospects, one vendor with a winning Facebook ad formula can deliver results. Consider starting a direct mail campaign with plenty of time, because direct mail campaigns can take four to six weeks to turn around.

Cross-Sell Your Existing Book of Business

During the shutdown, SMS leaders advised agents to use the "down time" to make their time more productive.

“For those agents that utilize workshops, walk-ins and face-to-face appointments, this may be the perfect time to focus on something that perhaps they do not do as well as they would like, and that is cross-sell their existing book of business,” said Dwane McFerrin, Senior Vice President of Med Solutions at SMS. “I believe consumers are more likely to open and read their mail now than they have for decades. Catchy email subject lines will also produce a better result.”

For agents specializing in Medicare, McFerrin suggested cross-selling dental insurance and hospital indemnity insurance.

“Advisors looking for additional opportunities outside of annuity solutions really need to look no further than life insurance,” said Bill Kauffman, Vice President of Financial Solutions at SMS. “In times of trouble, we all think about what would happen to our families and our legacy if something should happen to us sooner rather than later.”

The Setting Every Community Up for Retirement Enhancement Act, known as the SECURE Act, opened up opportunities for advisors after being signed into law in December 2019. Perhaps the most significant change to come out of the act was the requirement that most nonspouse beneficiaries must withdraw taxable, inherited IRA assets within 10 years, rather than stretching them over their lifetime.

“Any trust that was drafted with the idea of using the ‘stretch IRA’ concept to leave our qualified dollars to someone other than our spouse, needs to be structured differently,” Kauffman said. “Using required minimum withdrawals (RMDs) or some of our qualified dollars to purchase life insurance will solve the elimination of the stretch and allow the beneficiary to receive the proceeds tax-free.”

If you’re an annuity agent who wants to help clients with their Medicare needs but doesn’t want to sell Medicare, you can still earn referral fees by referring clients to Medicare BackOffice®, when the client purchases a plan.

Here for All Your Challenges

Whatever your specific challenges are, you can rely on SMS to help you face them. Your clients need your guidance and reassurance in uncertain times, and to help you provide that, SMS will be here for you.

For more information on any of the programs or tools mentioned here or to talk through your challenges, call an SMS marketing consultant at 1.800.786.5566.

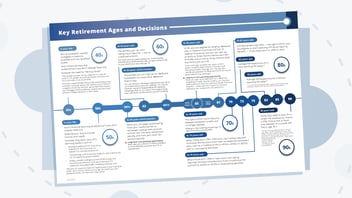

The Retirement Timeline: A Powerful Tool To...

As a financial professional, you know how easy it is for clients to delay retirement planning. The problem isn't always lack of awareness — it’s...

Help Clients Fund Long-Term Care and Save...

If you have a client with an annuity needing to address the financial risk of expensive long-term care (LTC), there’s a smart strategy involving the...