The Birthday Rule: Is It in Your State and What It Means for Agents and Med Supp Clients

Birthday rule legislation was introduced to address a significant gap in the Medicare Supplement (Med Supp) policy market. Traditionally, Medicare Advantage clients have the opportunity to shop and switch plans annually during the open enrollment period starting October 15 and running through December 7. However, this flexibility was not available to Med Supp policyholders, putting them at a disadvantage as they aged and their health potentially deteriorated.

To mitigate this issue, certain states have enacted the birthday rule. This legislation allows Med Supp policy owners the opportunity to shop for plans that better suit their needs and budget, without the fear of being declined due to health reasons. Essentially, it aims to provide a level playing field, ensuring that Med Supp policyholders can also benefit from competitive rates.

How the Birthday Rule Differs by State

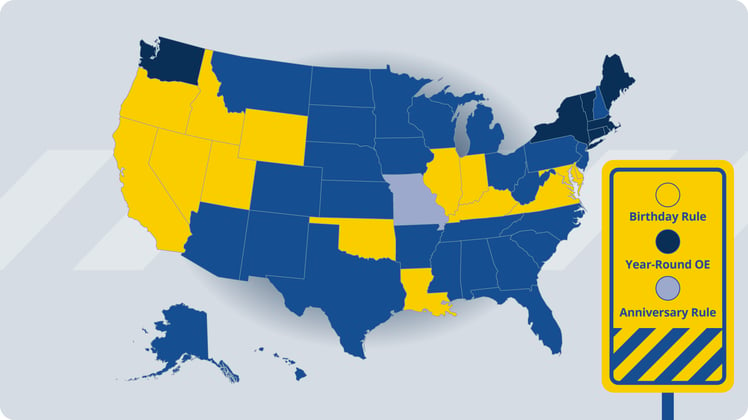

While the birthday rule offers a valuable opportunity for Med Supp policyholders, its implementation is not uniform across the United States. Each state that enacts this legislation has its own specific rules and time frames. Generally, the birthday rule period begins on the policyholder's birthday and lasts for a specified duration, such as 60 days. During this time, policyholders can switch to a new plan with equal or lesser benefits without undergoing underwriting.

As of the writing of this article, 14 states have either enacted or are considering birthday rule legislation. However, the nuances of these rules can vary significantly. It's crucial for insurance agents to be well-versed in the specific regulations of each state they operate in to provide accurate advice to their clients. Resources like Telos Actuarial and state insurance department websites offer detailed information on state-specific variations.

In What States Does the Birthday Rule Apply?

Benefits for Med Supp Policyholders

The primary benefit of the birthday rule for Med Supp policyholders is the ability to shop for the best possible rates without the risk of being declined due to health issues. This level of security is particularly important as policyholders age and their health may decline, making it more challenging to switch plans while getting an affordable rate under normal circumstances.

Moreover, the birthday rule encourages a more competitive market. Policyholders can compare different plans annually to ensure they are getting the best value for their money. This ability to switch plans without underwriting fosters a sense of financial security, knowing that they can always find a plan that meets their needs without the fear of exorbitant premiums due to health conditions.

Impact on Insurance Carriers and Agent Commissions

While the birthday rule offers significant benefits to policyholders, it also presents challenges for insurance carriers and agents. Since carriers are required to issue policies without underwriting, they have adjusted by increasing overall rates to maintain profitability. In some cases, rates have increased by as much as 40%.

Additionally, agent compensation has been affected. To offset the financial impact of guaranteed issue policies, some carriers have decreased agent commissions. This change can be a concern for agents who rely on commissions to maintain profitabililty. However, understanding these dynamics is crucial for agents to navigate the changing landscape and continue to provide valuable services to their clients.

Why Agents Must Stay Informed About the Birthday Rule

For insurance agents offering Med Supp plans, staying informed about the birthday rule is not just beneficial—it's essential. Agents have a responsibility to provide accurate and up-to-date information to their clients to help them make informed decisions. Given the variations in birthday rule legislation from state to state, agents need to be knowledgeable about the specific rules in the states they operate in.

Furthermore, understanding the implications of the birthday rule on rates and commissions allows agents to better prepare for conversations with clients and manage their expectations. By staying informed, agents can provide exceptional service, ensuring that their clients are in suitable plans that meet their needs and budget.

How SMS Supports Insurance Agents

Navigating the complexities of the birthday rule can be challenging, but insurance agents don't have to do it alone. Senior Market Sales® (SMS) offers invaluable support to agents, helping them interpret birthday rule legislation and understand its implications. SMS provides guidance to ensure that agents can offer suitable options to their clients while still ensuring they are compensated fairly for their work. SMS even provides access to its State Legislative Tracker where you can see whether a birthday rule law is proposed in a state and what the status of said proposal is.

It’s difficult to keep straight all the states, their rules, carriers available and your compensation structure. Fortunately, your SMS marketing consultant keeps track of all that for you. All you have to do is reach out, and your marketing consultant can get you the answers you need to these important questions.

Moreover, SMS leadership is actively involved in advocating for agents' interests in Washington. By working with legislators and regulators, SMS aims to address the challenges posed by loss ratios and pricing increases on Med Supp plans. Through a coalition of industry voices, SMS strives to protect agent commissions and client interests, ensuring a balanced and fair marketplace.

If you have any questions or need assistance, we’re just a phone call away. SMS has more than four decades of experience in helping agents save time, make more money and differentiate themselves in a competitive market. Reach out and speak with an SMS Med Solutions marketing consultant today at 1.877.888.9996 to learn how they can support you in navigating the birthday rule landscape.

Enhanced Medicare Quoting and Enrollment...

Agents who offer Medicare solutions need tools that help them maximize their time, allowing them to assist as many clients as possible. This is...