How Nextek’s Case Central Reports Spell Retirement Planning Success

Insurance agents and financial advisors need ways to engage clients for maximum retirement planning success, and the Nextek platform is your answer. Nextek continues to redefine what’s possible in insurance and retirement planning. One of the most powerful tools within Nextek is Case Central — a planning engine that transforms client data into five personalized, professional-grade reports. The reports act as retirement planning tools that help agents engage clients, drive meaningful conversations and close more sales — especially when it comes to retirement income and annuity solutions.

Here’s a closer look at how Case Central works and why it’s becoming a favorite among financial professionals.

What is Case Central?

Case Central is a centralized planning hub within the Nextek platform that allows agents to enter key client information once, and generate up to five distinct consumer-focused reports. These reports are ideal for client meetings and promoting as a value add to prospects.

Whether you’re discussing Social Security strategies, risk allocation, or a comprehensive retirement income plan, Case Central delivers professional, personalized output that builds credibility and drives action.

Entering Client Data

The first thing you need to do when utilizing Case Central, is create a consumer record by completing a Consumer Details Worksheet. This process is straightforward and designed to minimize repetitive data entry. Key information includes:

| Assets | Income Sources | Retirement Details |

| Current financial holdings across all accounts | Pensions, Social Security, rental income, etc. | Includes income goals, desired retirement age and inflation considerations (like cost of living adjustments) |

The beauty of Case Central lies in its efficiency. You enter the consumer data once in order to generate five reports tailored to the individual client.

Each report is:

- Personalized with the client’s name and the date it was created

- Branded with your name and logo on the coversheet

- Professionally formatted for easy presentation and discussion

How These 5 Reports Drive Value

Let’s dive into the reports available through Case Central, and learn a bit about how they can elevate your conversations with clients.

Report No. 1 – Financial Overview Report

Think of this as your client’s financial snapshot. It summarizes:

- Current assets and account types

- Income sources (both current and projected)

- Retirement goals and time horizon

- Cost of living assumptions

This report serves as a foundation for deeper planning conversations. It ensures both the agent and the client are working from the same set of facts and priorities.

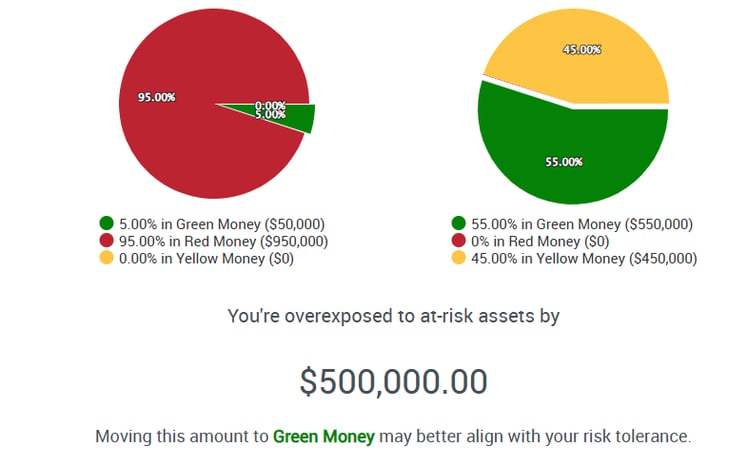

Report No. 2 – Color of Money Report

This report connects with the Color of Money Risk Analysis, another built-in Nextek tool. It helps clients understand:

- Their personal risk tolerance

- How their current assets are allocated in regards to risk

- Whether their portfolio aligns with their retirement timeline and goals

Agents use this report to stress the importance of being more risk adverse as clients approach or enter retirement. Plus, it's a great way to introduce clients to low-risk solutions like fixed indexed annuities.

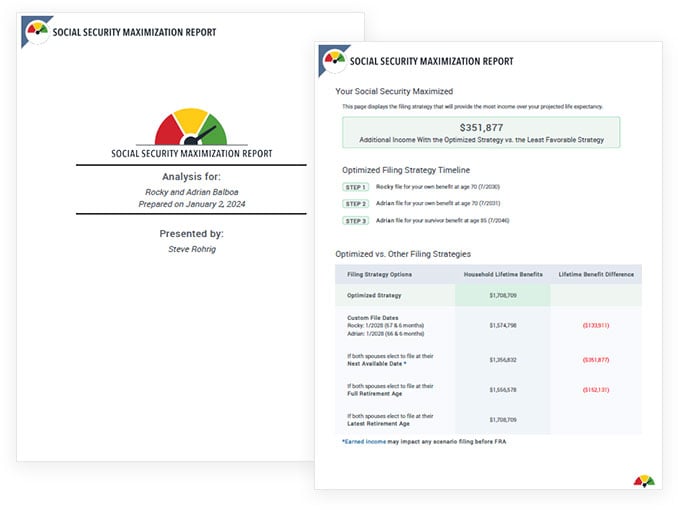

Report No. 3 – Social Security Maximization Report

With dozens of possible filing strategies, Social Security can be confusing for clients. This report does the heavy lifting by:

- Analyzing every possible strategy based on the client’s profile

- Illustrating optimal filing options for lifetime income

- Showing comparisons between filing early, at full retirement age and delayed strategies

This makes it easier for agents to educate clients and help them make smart, confident choices. Plus, it reinforces their role as a retirement planner.

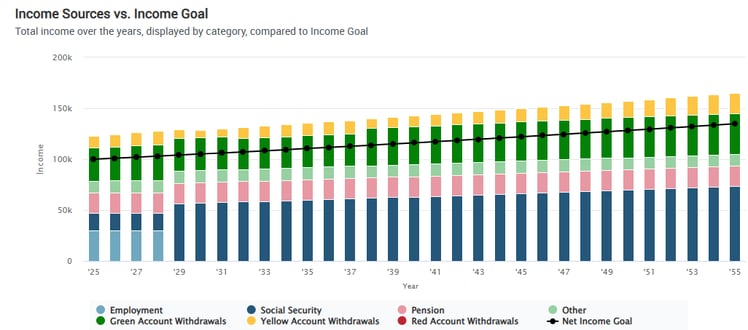

Report No. 4 – Retirement Compass Report

This comprehensive report is the heart of the retirement income planning process. It brings together client goals, risk tolerance, asset mix and income needs to create personalized retirement income scenarios. It can include:

- Year-by-year cash flow projections

- Analysis of income gaps

- Risk-adjusted strategies to preserve principal and grow assets

Use this report to show clients how annuities, Social Security and other strategies can combine to create a predictable, sustainable income stream.

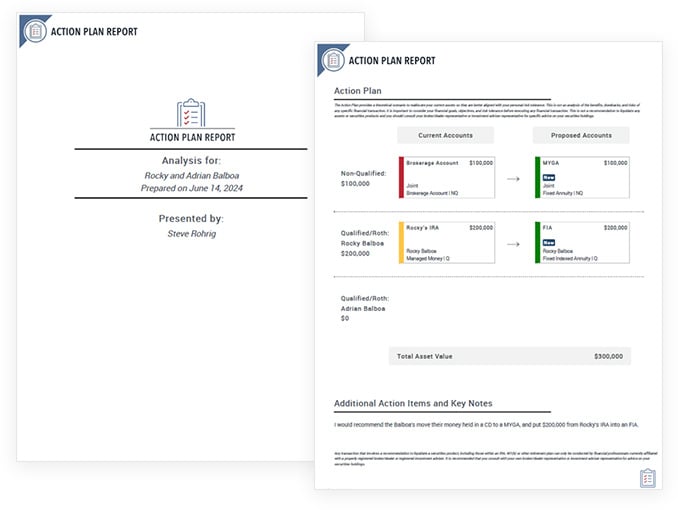

Report No. 5 – Action Plan Report

After any client meeting, follow-through is critical. This report:

- Summarizes your recommendations

- Highlights important next steps

- Documents the plan so the client knows exactly what to do

It helps maintain momentum, provides written accountability and reinforces the value you bring as a trusted advisor.

Why Agents Love Case Central

Beyond the reports themselves, Case Central delivers serious business-building advantages. Here are a few of the top advantages:

- Time-saving efficiency — enter data once for use in five reports

- Professional presentation — impress clients with quality, easy-to-read, print-ready material

- Consistency — every client receives a quality, repeatable process

- Sales enablement — these reports work well in supporting annuity sales, asset reallocation strategies, income planning solutions and more

How do I get started with Nextek?

Nextek is available through Senior Market Sales® (SMS), a premier field marketing organization with more than 40 years of experience helping agents in the health and wealth space. Fill out the form, or reach out to an SMS marketing consultant today at 1.800.786.5566 to request a demonstration of the Nextek platform. Your marketing consultant will help get you up and running with this versatile tool, and provide hands-on support so you can start turning conversations into comprehensive plans.

Want to discover more about Nextek? Take a look at the following:

Nextek: Simple and Effective Lead Generation...

The financial services industry continues to evolve. To keep up, successful insurance agents need tools that can:

Stay Top-of-Mind With Clients Using Campaign...

Insurance agents need more than just knowledge and great products, they need powerful tools to stay connected and relevant to their clients and...