When it comes to providing term life insurance quotes, speed, accuracy and professionalism matter. Gone are the days of manually comparing carrier rates in spreadsheets, or toggling between websites to determine underwriting eligibility. Life insurance needs analysis that adequately helps you and the client. With Vive, agents have access to a powerful life insurance quoting and comparison tool. It is tablet- and mobile-friendly. Plus, it’s designed to help you quote and submit life insurance applications faster, easier and more profitably than ever before.

Vive is your answer to these questions:

- What is one of the best tools for creating financial reports, and what are the benefits

- How can I quickly and accurately assess a client’s life insurance needs without manually running multiple calculations

- How can I make complex life insurance concepts understandable for clients

- Is there a platform that allows me to visually demonstrate insurance scenarios and outcomes

- Is there a way to automate repetitive life insurance analysis tasks so I can focus more on client relationships

The Power of Vive

Vive is a next-generation life insurance tool technology platform that transforms the way you quote and sell term life insurance. Designed specifically for insurance professionals, Vive gives you the ability to instantly compare carriers, determine underwriting eligibility and submit term life cases — all within minutes.

Whether you’re meeting clients in person or virtually, Vive’s streamlined interface helps you make confident and data-driven recommendations, while at the same time enhancing the client experience.

Using Vive in 3 Easy Steps

This user-friendly tool can be mastered in just three simple steps. Step one entails entering the client’s information. Step two involves getting the data. The last step is the best one of all — submitting and tracking your case.

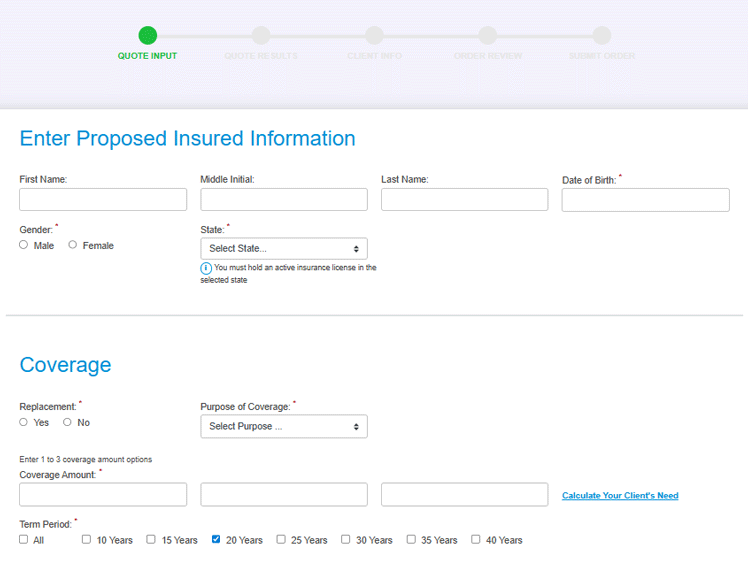

Step No. 1 – Entering Client Information

Get started by entering your client’s key details — such as desired coverage amount, term length, health information and any optional riders. Need help determining how much coverage your client really needs? Vive includes a built-in life insurance calculator that helps estimate the appropriate coverage amount based on their financial goals and family’s needs. This step alone saves valuable time and ensures your clients receive personalized recommendations right from the start.

Step No. 2 – Reviewing Instant, Data-Driven Results

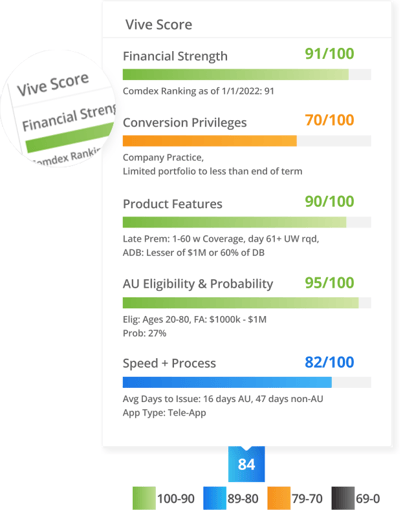

Once you’ve entered the client information, Vive instantly generates side-by-side comparisons from multiple carriers. But it doesn’t stop at just showing prices.

Each carrier and product is assigned an exclusive Vive score, which ranks options based on multiple factors, including:

- Financial strength — ensures your clients are working with highly rated, reputable carriers

- Conversion privileges — helps identify which policies offer flexibility for future life stage changes

- Product features – evaluates riders, benefits and customization options available to your client

- Accelerated underwriting and probability — instantly shows if your client qualifies for faster, no-exam approval

- Speed and process — rates how quickly each carrier can process and issue a policy

This multi-factor comparison gives you and your clients more than just a price point, it provides clarity, confidence and credibility behind every recommendation.

Step No. 3 – Submitting and Tracking

After reviewing the results, you can submit the application directly through Vive. There is no:

After reviewing the results, you can submit the application directly through Vive. There is no:

- Need to re-enter data

- Hardcopy paperwork to complete

- Clunky transition between systems

Vive allows you to track each case from quote to policy issue, providing complete transparency along the way. You’ll know exactly where your client’s application stands from beginning to finish.

If your clients qualify for accelerated underwriting, then the entire process — from quote to submitted application — can take less than five minutes!

A Real Agent Success Testimonial

“Vive was incredibly easy to use! I quickly compared multiple term insurance options and was able to purchase policies for both my wife and me within minutes. The ability to compare plans based on more than just price was extremely valuable.” – Curtis L.

Why Agents Love Vive:

- Fast and intuitive quoting — generate multiple carrier comparisons in seconds

- Accelerated underwriting — instantly see which clients qualify for no-exam applications

- Mobile-friendly — use Vive anywhere, from any device

- Data-driven recommendations — leverage the Vive Score to confidently explain your choices

- Streamlined submissions — complete and submit applications directly from the platform

Vive not only saves time, it helps agents build stronger relationships with clients by simplifying what was once a complicated process.

When combined with the expertise and resources of premier field marketing organization, Senior Market Sales® (SMS), Vive becomes more than just a quoting tool, it morphs into a complete solution for term life insurance sales.

Unmatched Support From SMS

At SMS, we know technology is only as valuable as the support that stands behind it. That’s why our life insurance team provides unparalleled assistance every step of the way. With more than a century of combined experience, SMS’ life insurance marketing consultants help agents integrate Vive into their business through onboarding, training, case design and sales strategies.

The Bottom Line

In today’s fast-paced marketplace, you need technology tools to help you differentiate from the competition. Vive is at the forefront of life insurance needs analysis software and allows you to deliver both efficiency and professionalism, which are key differentiators. By leveraging Vive through an SMS partnership, you’ll spend less time managing technology and more time doing what you do best — helping clients protect their legacy and financial future.

Looking for more info on Vive and other tools? Read 1 Place to Access 3 Proven Tools for Financial Success.

Get Started With A Demo of One of the Best Financial Industry Analysis Tools

With Vive and SMS, you’ll be equipped with the tools, training and technology to take your life insurance business to the next level. Looking for even more value? SMS offers an entire suite of sales tools designed specifically to help insurance agents and financial professionals excel in the health and wealth markets.

Dwane McFerrin Receives Underwriter of the...

The Omaha Association of Health Underwriters (OAHU) has selected Dwane McFerrin, Senior Vice President, Med Solutions at Senior Market Sales® (SMS),...