Whether you’re an independent insurance agent, financial planner or a registered representative, the future of your business depends on how you adapt to the massive changes disrupting the retirement planning industry. But with so many factors driving the change — shifting demographics, evolving client expectations, regulatory challenges and rapid technological advancements — how do you know where to begin?

Senior Market Sales® (SMS) breaks it down into three manageable steps, with three resources that help you take action — and take control of your future, so the disruption doesn’t control your fate.

1. Understand the Challenges and Opportunities

Cumbersome regulations. Dropped Medicare plans and commissions. Consumers using artificial intelligence to pick investments and to shop online for insurance.

— To Guide You —

If you’re on the frontlines selling insurance or creating retirement plans, you know the issues personally. And daily headlines warning of impending doom don’t help either. On many days, it may seem like your livelihood is at stake.

But is it really?

With change comes opportunity — even when the change may seem so overwhelming that the opportunity is unclear. Only when you understand the whole landscape can you make a plan that prepares you to weather the changes and to grow. And with a clear path, you encounter fewer obstacles and less stress. The SMS white paper, “The Retirement Planning Mind Shift: New Thinking for Growth in a New Era,” explains the issues and connects the dots on how they may impact your future.

Planning Model of the Future

The white paper covers key demographic shifts, including the immediate “Peak 65” opportunity, the “Great Wealth Transfer,” Generation X and millennial customer preferences, and the growing power of women with wealth. It also identifies emerging markets, the need for financial literacy, and surprising consumer behavior such as the “spend-down paradox” and the “annuity puzzle.”

The white paper asserts that the most successful business models of the future will provide holistic in-house services or partnerships among professionals to serve all of a client’s health and wealth needs. In an increasingly commoditized space, new technology that helps professionals work faster, see more clients, solve complicated problems and provide a better customer experience will be critical to meet client demands and keep the business profitable.

By understanding the issues along with exclusive insights from the most experienced leaders in the retirement planning space, you will be better positioned to meet the needs of your clients and grow your business.

2. Decide Your Path

Once you understand how the issues outlined in the white paper could impact your particular business, you need to decide how to move forward. No one knows your business better than you, so only you can decide what you’ll need to do.

— To Guide You —

SMS makes this easier, however, by narrowing the options to the smartest, most effective ones. Known for leading agents and advisors through industry changes for more than four decades, SMS applied its expertise to the latest round of change, analyzing dozens of research studies, surveys, government data, and media reports to create not only the white paper but also its companion guide, “7 Paths to Growth in the New Retirement Era.” This free guide provides specific, actionable steps to position your business for success as the industry changes.

You may choose one path, a combination of paths or all of them.

Whether you decide to become hyper-specialized in a niche service or expand your business model to cover holistic planning, the range of opportunities in the guide allows you to customize your path. Pivoting entirely or even tweaking your business slightly may seem daunting, when you’re already struggling to keep up with the demands of running a business. That’s why, in a marketplace that’s only demanding more and more of independent agents and advisors, choosing the right support partner is one of the most important decisions that you will make — no matter which path or paths you choose.

White Paper excerpt

Exclusive Opportunities and Support for Agents and Advisors in Retirement Planning

Just as you’re the only one who knows the right path or paths for your business, SMS is the only IMO that knows about certain opportunities. Likewise, SMS is the only support organization providing the resources and infrastructure that make these opportunities available.

SMS entered into a strategic alliance with Alliant Insurance Services in 2020, and this alliance has positioned its contracted agents and advisors to prepare for the changes the industry is experiencing today.

Alliant, one of the nation’s largest insurance distributors, and SMS are building the retirement planning industry of tomorrow by filling gaps in the retirement planning system. Instead of agents and advisors working in silos providing limited services, they can work together to meet all of a client’s health and wealth needs.

SMS’ white paper provides the thought leadership — the change in thinking needed to actually evolve traditional retirement planning services. And the “7 Paths” guide reveals specific, new ways agents and advisors can make the changes. These involve adding products and services to expand existing business models or referring clients to networks of other professionals. And they are opportunities exclusive to SMS, possible because of SMS’ exclusive partnership with Alliant.

Read more about why SMS is considered the best IMO, or field marketing organization (FMO) in the industry.

The “7 Paths to Growth in the New Retirement Era” may help you answer questions such as these:

- Should I expand my insurance agency/planning practice?

- What is holistic planning?

- Should I refer clients to other professionals?

- Should I add holistic planning to my business?

- What is multi-generational planning?

- How do I find other professionals to refer clients to?

- How should I rework traditional roles in my business?

- Should I leave my broker-dealer and go independent?

- Is buying a book of business a way to grow my practice?

- What is a retirement navigator?

- How can my business attract younger clients and women?

- How can the latest tech save me time and money?

- Is financial literacy important for my clients’ success?

- How can I work financial wellness into my business?

Alliant and SMS identified the problems and obstacles for both consumers and the professionals helping them. By filling gaps in the retirement system, SMS and Alliant are empowering independent agents and advisors to improve client outcomes. When you solve problems in the marketplace, everyone wins — you improve client lives and grow your business.

Get the free “7 Paths to Growth in the New Retirement Era” guide.

3. Attract Clients

As much as the industry is changing, one thing remains the same: the agents and advisors of today and tomorrow need leads.

But, as shown in the white paper, shifting demographics, consumer preferences, and other issues are only making prospecting more challenging. Outdated marketing materials and approaches might fail to resonate with new generations. How and where prospects shop for insurance and seek retirement guidance is evolving, especially with the AI advances in recent years.

— To Guide Your Clients —

As you likely know firsthand, professionals in the independent space do not have spare time and resources to research consumer preferences, produce timely marketing content and distribute it at a scale and frequency that will sustain business, let alone grow it.

Partnering with an IMO that has proven marketing content and turnkey systems to attract and convert leads to clients will be even more necessary in the new retirement planning era. Working efficiently so you can see more clients will be critical in order for you to grow. Diversifying your income streams may become necessary. If an IMO isn’t providing you with innovative thinking and marketing materials that reach and resonate with your targeted consumers, the competition might snatch them first.

To help you attract leads in the changing retirement planning marketplace, SMS created a consumer-facing guide, “Your Core Retirement Decisions.” Featuring a cover that you can customize with your business’ name and contact information, the retirement planning guide clearly explains the challenges retirees face and the decisions they’ll need to make.

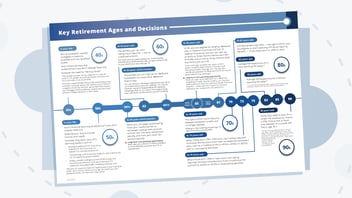

Its centerpiece is a centerfold timeline displaying ages when retirement decisions typically are made, including defined ages for events like enrolling in Medicare, claiming Social Security and taking Required Minimum Distributions (RMDs). It also shows broader age ranges for possible retirement strategies such as buying an annuity or funding long-term care.

As the white paper and “7 Paths” agent guide called for, the consumer guide takes an educational approach. By bypassing traditional sales-pitch-filled marketing, you build trust with prospects.

The guide is part of an entire marketing system based off that educational approach. The SMS Client Stream® marketing platform features:

- Done-for-you, compliant PowerPoint presentations that you can use for one-on-one meetings or workshops held virtually or in-person

- Posters, emails and social media posts and ads to help you promote your educational workshops or personal appointments

- More educational resources, such as a Medicare guide, estate planning checklist and a guide on navigating the death of a loved one

You can offer a download or printed version of the “Your Core Retirement Decisions” guide at your workshops to incentivize attendees to book appointments. You also can give the guide or other educational resources to existing clients, positioning yourself for cross-sell opportunities or referrals to professionals who can help them.

The Core guide and presentation are designed to help you deliver a big-picture overview of retirement to position you as their main retirement navigator, whether you are specialized or holistic. Working with SMS, you can evolve your business model to refer clients to other professionals and potentially receive commissions or expand your services. (The white paper and guide include more information about the SMS family of companies that are available for you to refer to, including Medicare BackOffice®, Sequent Planning® and Retirement Planning Center® and Travel Insurance Center®.)

An Entire Marketing System to Generate Leads

If your product and service offerings are specialized or if you simply want to dive deeper into individual retirement topics, Client Stream offers marketing materials, presentations and other consumer-facing resources on those topics, including:

- Long-term care planning

- Claiming Social Security

- Enrolling in Medicare

- Understanding annuities

- Taxes in retirement

Offering workshops in your community is known in the industry as one of the most effective lead generators — agents who have used workshops to attract leads have claimed lead-to-appointment conversion rates of 60 to 70%.

The “Your Core Retirement Decisions” guide and marketing system are designed to help you stand out from competitors, who without adopting new thinking and approaches, will continue operating in silos. As customers seek all-in-one-place conveniences, you will stay a step ahead.

Request your copy of “Your Core Retirement Decisions.”

When paying for leads, SMS also offers a solution — Client Stream Lead Exchange, a multi-vendor lead-generation marketplace that saves you time and saves you money by delivering high-quality leads. SMS marketing consultants also are available to coach you on all your lead-generation needs.

Help Clients With All of Their Retirement Needs

Agents and advisors who care about their clients inevitably struggle with how to help clients with all of their retirement challenges. SMS and Alliant are empowering independent agents and advisors with resources and support that keep you focused on caring for clients and help you scale your business. The white paper, agent guide and consumer guide are just a few of the FREE resources that SMS provides to contracted agents and advisors.

To learn about all the ways SMS can help you grow your business in the new retirement era, call an SMS marketing consultant today at 1.877.645.4939.

Senior Market Sales® Acquires EMG Insurance...

Collaboration Among SMS’ Acquired Partners Creates Exclusive Opportunities for Growth

The Retirement Timeline: A Powerful Tool To...

As a financial professional, you know how easy it is for clients to delay retirement planning. The problem isn't always lack of awareness — it’s...